Routing Number Lookup

Search routing number validation

Lookup example: 021000021

What Is Routing Number?

A Routing Number (also called routing transit number) is a nine-digit code that identifies financial institutions in the United States. US Bank Routing Number recognizes the area where your account was opened.

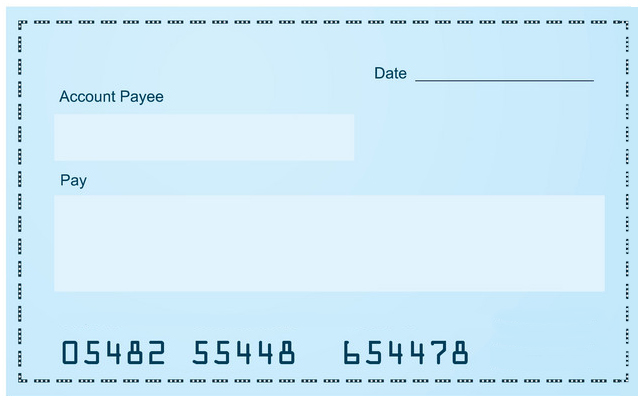

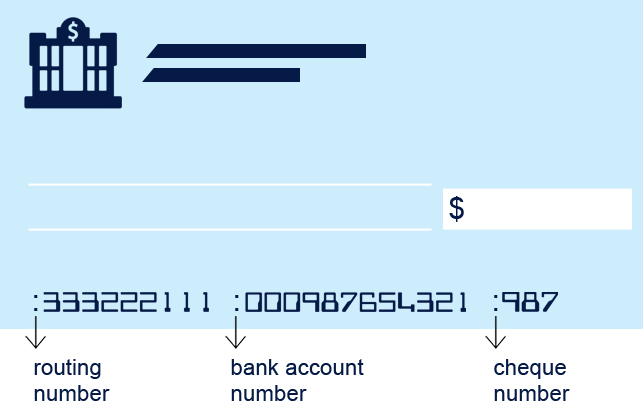

Your account number (typically 10-12 digits) is explicit to your account. The second arrangement of numbers imprinted on the lower part of your cheques, just to one side of the bank, is the routing number.

You’ll regularly be requested your account routing number when making a payment through a telephonic conversation or online. It is mostly used to make the exchange of cash between financial institutions more secure and smooth through frameworks like ACH, Fedwire, check, and so forth.

According to the established policy, each financial institution can theoretically apply for up to 5 routing numbers. Generally, numerous establishments have more than 100 routing numbers under the umbrella due to consolidations, mergers, or acquisitions. The banks or credit unions that have multiple routing numbers may utilize diverse numbers for various purposes.

Exclusive regions or exclusive types of accounts, such as a business account, can be assigned some exclusive routing numbers through some financial institution. Additionally, once in a while, old accounts of an acquired or merged bank can also use a routing number.

In this manner, twofold check and utilization of the correct Bank of America Routing Number should be prioritized before making or receiving a payment.

US Bank Routing Numbers

| State | US Bank routing number |

|---|---|

| US Bank Arizona | 122105155 |

| US Bank California, Southern | 122235821 |

| US Bank Idaho | 123103729 |

| US Bank Indiana | 74900783 |

| US Bank Kansas | 101000187 |

| US Bank Minnesota, East Grand Forks | 91215927 |

| US Bank Missouri | 81000210 |

| US Bank Nebraska | 104000029 |

| US Bank North Dakota | 91300023 |

| US Bank Oregon | 123000220 |

| US Bank Utah | 124302150 |

| US Bank Wyoming | 307070115 |

| US Bank Arkansas | 82000549 |

| US Bank Colorado, Aspen | 102101645 |

| US Bank Illinois, Northern | 71904779 |

| US Bank Iowa, Council Bluffs | 104000029 |

| US Bank Kentucky, Northern | 42100175 |

| US Bank Minnesota, Moorhead | 91300023 |

| State | US Bank routing number |

|---|---|

| US Bank Missouri, Western | 101200453 |

| US Bank Nevada | 121201694 |

| US Bank Ohio, Cleveland | 41202582 |

| US Bank South Dakota | 91408501 |

| US Bank Washington | 125000105 |

| US Bank in all other states | 91000022 |

| US Bank California, Northern | 121122676 |

| US Bank Colorado | 102000021 |

| US Bank Illinois, Southern | 81202759 |

| US Bank Iowa | 73000545 |

| US Bank Kentucky, Southern | 83900363 |

| US Bank Minnesota | 91000022 |

| US Bank Montana | 92900383 |

| US Bank New Mexico | 107002312 |

| US Bank Ohio | 42000013 |

| US Bank Tennessee | 64000059 |

| US Bank Wisconsin | 75000022 |

Debugging Routing Number Format

Originally, the idea of Routing Numbers was bought in force by the American Bankers Association (ABA). The agenda was to keep the circulation of paper checks organized, especially when the usage was extensive. They are popularly referred to as ABA routing numbers or American Clearing House (ACH) routing numbers and can be found on personal checks, bank websites, or the ABA’s online database.

How can you check routing number is a question from most people? This material information can be extracted in many ways. The most convenient and quickest is referring to the bottom of your cheque, in the bottom left-hand corner. The nine-digit number routing number will be visible elsewhere in some computer-generated cheques. Moreover, you always have the option of contacting your bank to ask about the same. The majority of financial institutions provide this data online.

You can also check Routing Number through the formula below.

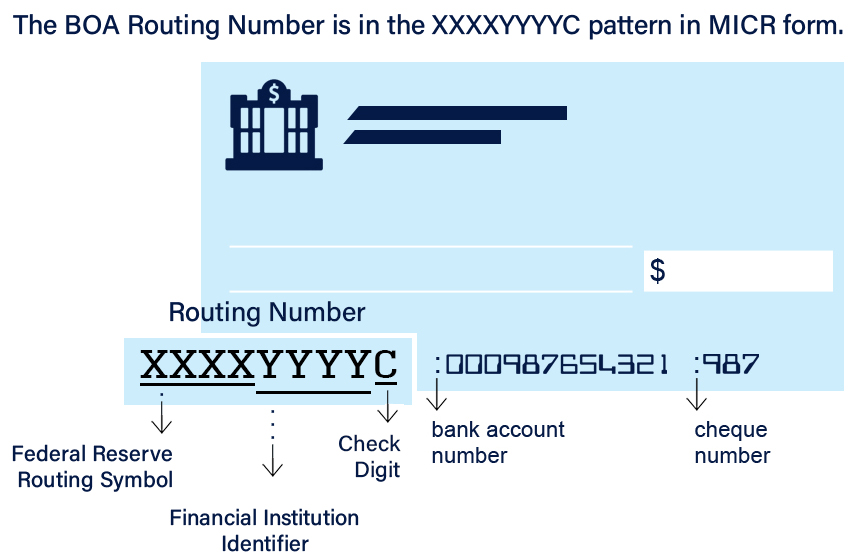

Fraction Form and MICR (magnetic ink character recognition) form are two types in which Router Number is available. Both forms hold the same information. MICR form is more popular, and it is uncommon to see the fraction form in the current times.

The first two digits can only be 00 – 12, 21 – 32, 61 – 72, or 80, within the 4-digit Federal Reserve Routing Symbol. 21 – 32 are assigned to thrift institutions in this bracket only, such as credit unions and reserve funds banks. The special purpose number range includes 61-72 for non-bank payment processors and clearinghouses and is termed Electronic Transaction Identifiers (ETIs). 80 is for traveler’s checks. Besides 80, the initial two digits can be related to the 12 Federal Reserve Banks.

The ninth digit of the routing number is the check digit and must meet the following condition. This condition is involved chiefly to diminish misrouting mistakes, which are a result of input errors.

When providing routing and account numbers, it’s extremely essential that you double-check your entries. Any mistake or a loophole can result in failed transfers, or your precious and hard-earned money could end up to the wrong account. If you catch an error, notify your bank so it can reverse the transaction.

This is why Routing Number checker & validator routing number checker & validator holds high importance.

Routing Number is valid

Routing Number is valid